How an Aussie green energy crypto darling became fuel for fraudster’s ‘pump-and-dump’ schemes

Having once promised to ‘democratise energy’, Aussie block chain tech has become caught by the shadowy and unregulated world of crypto pump-and-dump schemes.

This is the story of the POWR (pronounced ‘power’) token, a cryptocurrency created by an Australian-based company called Powerledger that promised an “energy revolution” and the “democratisation of energy”, and how that coin slipped into the world of crypto fraudsters and their pump-and-dump schemes.

This story starts in 2017, when the technology sector was obsessed with Bitcoin, cryptocurrencies, and the hype around blockchain was reaching a level of mania that has since only been matched by that currently directed at AI platforms.

If you believed that hype, blockchain was an all-powerful panacea that had the potential to solve all the world’s problems. The hype perhaps peaked in absurdity with the rise and fall of ‘non-fungible tokens’ (NFTs) as a means of ‘digitising and democratising’ art, earning comparisons with Tulip Mania in the process.

But in certain applications, the opportunities for blockchain technologies were very real. With its promises of revolutionising the way that energy could be traded, tracked and verified across the vast and vastly complicated energy markets, blockchain developers attracted a lot of attention from the energy sector.

Out of this buzz emerged Powerledger, an Australian-founded blockchain platform that promises to “[leverage] blockchain technology to address the pressing challenges of intermittency and grid congestion caused by integrating renewable energy into the grid”.

Its business model has perhaps never been very well explained - it was never clear why blockchain technology was necessary to solve those problems - but in 2017 there were huge sums of money being poured into cryptocurrencies and blockchain platforms. Powerledger leveraged this excitement, raising a massive A$34 million through an ‘Initial Coin Offering’ of its POWR tokens. It was reported in the Australian Financial Review as “Australia’s first crypto IPO”.

Powerledger received most of that investment in the form of other cryptocurrencies – such as Bitcoin and Ethereum – and potentially benefited further from the subsequent increase in value of those cryptocurrencies.

Cashed up, Powerledger said it would use the funds it raised to support the development of its blockchain products – including a peer-to-peer energy trading platform, and a registry for issuing, trading and verifying renewable energy certificates – as well as investing directly in clean energy projects.

The hype was substantial. In 2018, Powerledger co-founder, Dr Jemma Green was named EY’s Fintech Entrepreneur of the Year. The team was flown to Richard Branson’s Necker Island where it was named as the winner of the 2018 Extreme Tech Challenge.

Powerledger established a base in Zug, Switzerland, a town colloquially known as “Crypto Valley” due to the large number of cryptocurrency ventures that have become headquartered there.

The company attracted the interest of the Australian Renewable Energy Agency, which provided grant-funding to early studies for a project that deployed Powerledger’s peer-to-peer energy trading platform at a residential development in Perth. Dr Green was also featured in an ARENA-produced “innovators” podcast.

But Powerledger ultimately struggled to commercialise its blockchain technologies. It closed a Melbourne office in 2019and a pilot of the technology by Origin Energy failed to progress beyond a “desktop trial”. In 2021, The Australian reported that Powerledger had generated just $250,000 in revenue from its blockchain software.

The price of the POWR token has mirrored these difficulties. Powerledger sold the initial batch of POWR tokens for just 5 cents each. Amid the hysteria around cryptocurrencies, the price of the POWR tokens rapidly surged in value, reaching $1.65 in early 2018 and Powerledger’s “market cap” peaked at around $650 million.

But as with most cryptocurrencies, that early excitement subsided just as quickly, and the price of POWR tokens had fallen below 10 cents before the end of 2018.

The tokens currently trade at around 15 cents each, with Powerledger’s market cap now at around $85 million.

Blood attracts sharks

It is clear the POWR token issued by Powerledger was created with the best of intentions; to support the development of new technologies that would enable greater uptake of renewable energy technologies. However, its real-world applications appear limited (although, it was apparently used to run VB’s solar-to-beer swap promotion in 2021).

Due to its reduced market capitalisation and the lack of regulation and oversight of cryptocurrency markets, the POWR token is one of many cryptocurrencies vulnerable to market manipulation.

There is strong evidence that the POWR token is now being targeted as part of fraudulent “pump-and-dump” schemes that seek to defraud other crypto traders. It’s not unique in this regard, many small and mid-tier cryptocurrencies become targets for fraud. Crypto market manipulation is now a multi-billion dollar industry.

For those unfamiliar, a pump-and-dump scheme is perpetrated by traders with huge sums of funds at their disposal, who identify a target cryptocurrency and, by suddenly buying large volumes of the coin, work to artificially and rapidly inflate the coin’s price (the “pump”).

This is done with the goal of drawing in other innocent traders who are attracted by the price spike and also begin buying the cryptocurrency, believing there’s an opportunity to profit.

However, once the price has spiked, and the other traders have been drawn into the trap, the “pumpers” then rapidly sell all the cryptocurrency they amassed at the inflated price, securing a profit (the “dump”).

This dump usually causes the coin’s price to collapse again, and the tricked traders are left holding a cryptocurrency that has substantially lost value. These schemes are generally illegal, but in the under-regulated and largely anonymous world of cryptocurrencies there is little to prevent its regular occurrence.

The Power pump-and-dumps

Market data shows that such schemes may have been perpetrated on multiple occasions using the POWR coin issued by Powerledger.

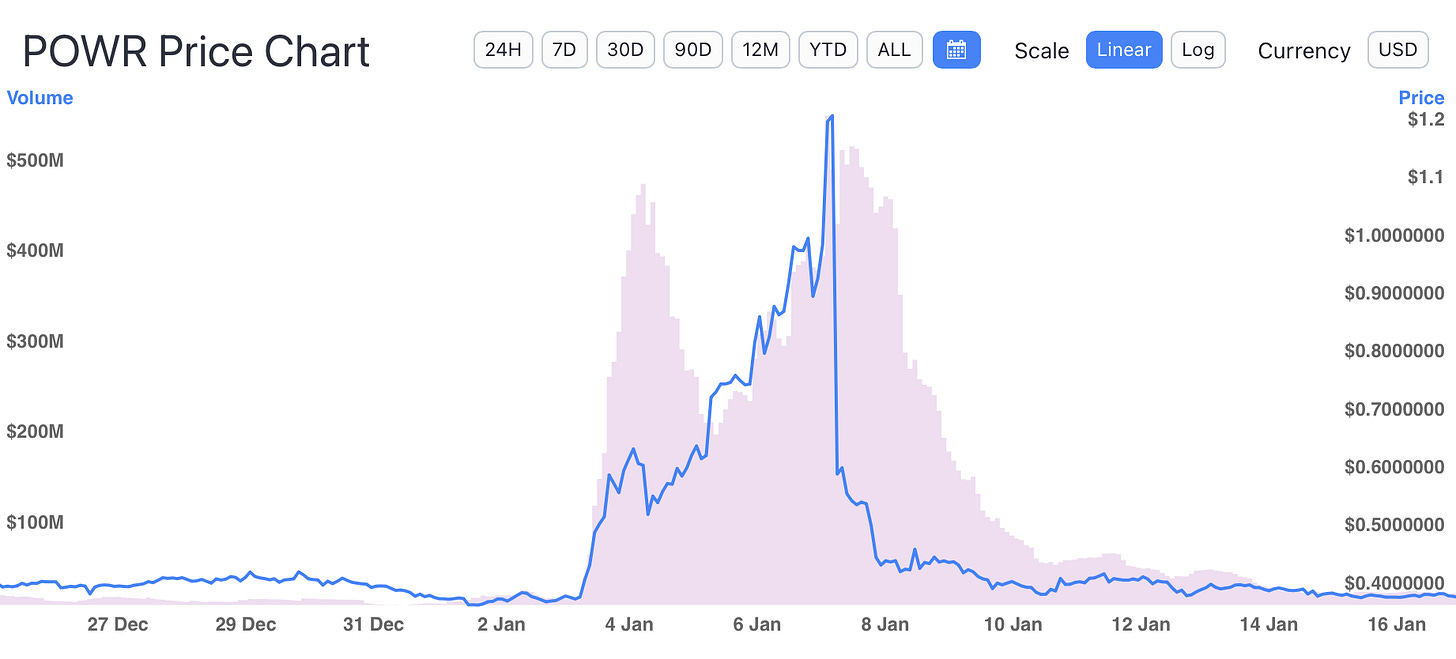

A clear example occurred in January 2024, where the price of POWR tokens increased by 330% over a 4-day period, only to then dramatically collapse, shedding two-thirds of the inflated value in a matter of hours.

It was a textbook ‘pump and dump’ scheme.

This YouTube breakdown from a crypto analyst provides a good breakdown of what occurred during the January 2024 incident.

Indicators of the pump-and-dump are the sharp increase in trading activity which disappears just as quickly, the sharp rise and fall in the price, and the extent to which the trading is related to any developments announced by the company itself.

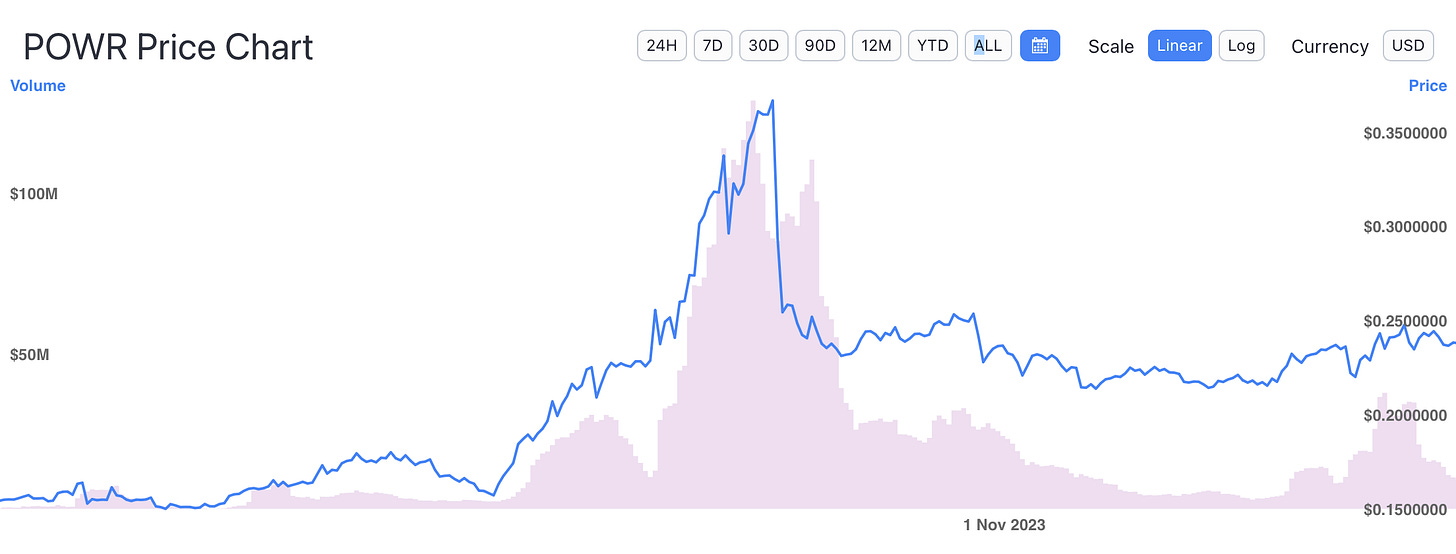

Similar spikes and collapses occurred in October 2023:

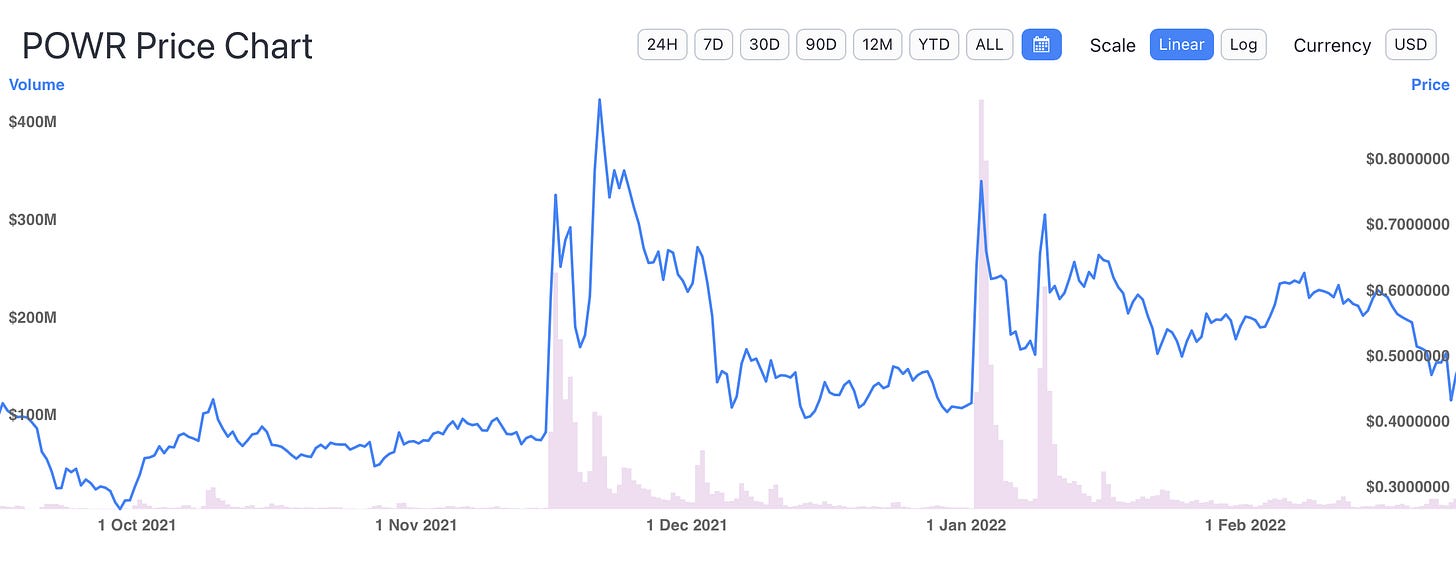

And more occured on multiple occasions in late 2021 and early 2022:

There is no evidence that the Powerledger company, or any of its co-founders or employees have done anything improper. No suggestion of wrongdoing on their part is being made in this story.

Crypto is inherently risky, and not a climate solution

There is a high general danger of using blockchain platforms as an alternative to traditional share placements – and as an investment more generally.

While Initial Coin Offerings theoretically can be used by ventures to raise funds to be invested in a range of virtual or real-world projects, cryptocurrencies are not subject to anywhere near the same level of regulation as share placements on exchanges like the Australian Securities Exchange or the New York Stock Exchange.

Ventures that issue cryptocurrencies do not have the same requirements to publish annual reports on their financial performance, and owners of cryptocurrencies may or may not have any meaningful rights as the owners of more traditional shares.

Ironically, it is the anonymous and decentralised nature of cryptocurrencies that makes the market so vulnerable to manipulation, and financial regulators are largely powerless to do anything about it.

The real-world deployment of blockchain technologies has also failed to offer any meaningful solutions to the climate crisis. In fact, they are generally working to make the problem worse. Like AI platforms, blockchain and crypto technologies demand huge volumes of computing resources that in turn drive significant increases in energy consumption.

While the usefulness of blockchain technology is debatable, its ability to drive increased fossil fuel consumption is very real.

Blockchain proponents had promised to change the world with their “decentralized, distributed, and transparent digital ledgers” and to “democratise energy”. But these promises have fallen flat.

The energy sector is still very much controlled by fossil-fuelled oligarchs.

Powerledger and its co-founder Jemma Green were contacted for this story, as was the Australian Renewable Energy Agency, but no response from either was received.

Thanks Michael - a good writeup. Unless a cryptocurrency is underpinned by a real asset and there is some mechanism to easily interchange for that asset, the risk of 'pump and dump' outcomes is high. Unless you are the pumper or dumper, best stay away from these currencies unless you have a real use case for transacting them.

Great write up! There was a story in the AFR covering Powerledger a few years ago and Dr Green successfully used for defamation. Must be a wild ride for Powerledger staffers...

There was another crypto/energy storystory with AEMO realising they had some crypto tokens in their books following Project EDGE. They promptly offloaded them and upset the people holding the coins because it tanked the price.